Australia’s construction industry set to regain growth momentum from 2020

25.07.2019

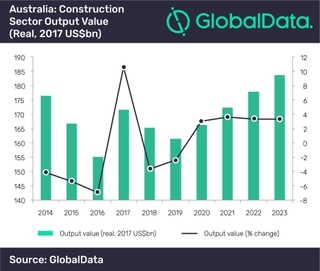

Australia: Construction Sector Output Value (Real, 2017 US$bn) (Figure: GlobalData Financial Deals Database)

Australia: Construction Sector Output Value (Real, 2017 US$bn) (Figure: GlobalData Financial Deals Database)

Australia’s construction industry, which is currently facing a troubled period, is set to regain growth momentum from 2020 on the back of a range of major infrastructure development programs and projects, according GlobalData, a leading data and analytics company.

GlobalData’s report, ‘Construction in Australia – Key Trends and Opportunities by State and Territory to 2023’, reveals that Australia’s construction industry’s output value, measured at constant 2017 US dollar exchange rates, declined from US$171.6bn in 2017 to US$165.3bn in 2018, reflecting a sharp drop in activity in the oil and gas sector as major projects were completed.

According to the report, the industry is expected to remain weak in 2019, contracting by 2.4% in real terms, an outturn that partly reflects a lull in activity in the construction of major energy projects but also a downturn in the residential sector.

Danny Richards, Construction Analyst at GlobalData, comments: “Residential construction accounted for 36% of the Australian construction industry’s total value in 2018. The residential sector has been expanding rapidly in recent years, but the consequent oversupply of residential buildings as well as tighter lending conditions will hamper the sector in the coming years, and by 2023 it will account for less than 32% of the industry’s total value.”

Highlighting the gloomy outlook for the residential sector, the total number of dwelling units approved in the country decreased by 22% year-on-year in the first four months of 2019, according to the Australian Bureau of Statistics (ABS), following declines of 5.8% in 2018 and 4% in 2017.

However, the industry’s output value in real terms is expected to rise at a compound annual growth rate of 2.14% over the forecast period (2019–2023), compared to -1.59% during the review period (2014–2018).

Richards concludes: “Australia’s construction industry will regain growth momentum from 2020. The improvement will be driven by investments in transport infrastructure, with the government planning to invest US$58.9bn to develop the country’s transport infrastructure by 2027–2028. Commercial and industrial projects and an improvement in consumer and investor confidence will also provide support, offsetting the downturn in residential construction.”

CONTACT

GlobalData

John Carpenter House

7 Carmelite Street, London

EC4Y 0BS/United Kingdom

+44 207 936 6400